This resource was originally published on the Sacred Sector blog. Sacred Sector, an initiative of the Center for Public Justice, launched in 2017 with the…

By Dr. Stanley Carlson-Thies The Small Business Administration (SBA) on April 3 issued a Frequently Asked Questions document affirming the eligibility of religious organizations, including…

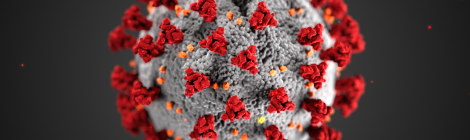

On March 27, 2020, the President signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act which provides a variety of forms of…

Check this page for updated resources about the religious freedom implications of the COVID-19 pandemic. Sign-On Letter: Faith Leaders Urge Congress to Protect Civil Society,…

The church parking tax imposed on religious and secular nonprofits as part of the 2017 tax reform law was repealed in December 2019. The repeal is not only important for relieving a financial and administrative burden on these community-serving organizations, but even more so for restoring the historic and constitutional independence of primary religious institutions from governmental pressures.

On January 17, 2020, the Trump administration proposed significant changes to the federal Equal Treatment regulations in major federal agencies. These regulations are designed to create an equal opportunity for faith-based organizations to compete for federal funding without minimizing their religious character. Several of the proposed changes further this aim, but others unnecessarily undermine the broad consensus in support of the regulations that has developed over two decades. Comments on the various NPRM are due no later than February 18, 2020, and can be easily submitted via http://www.regulations.gov. Consult each specific NPRM to find out how to make a comment on it.